Most traders ignore this vital truth about altcurrencies

I’ve been wanting RonPaulCoin(RPC) for some time. I’m not bullish on the currency, in fact, I think it’s a bad idea. Naming a currency after a personality, especially a living one (Teslacoin could be kind of cool) is a terrible idea. But especially because Ron Paul is such an anti-fiat-currency goldbug, I thought it would be funny to have one RonPaulCoin.

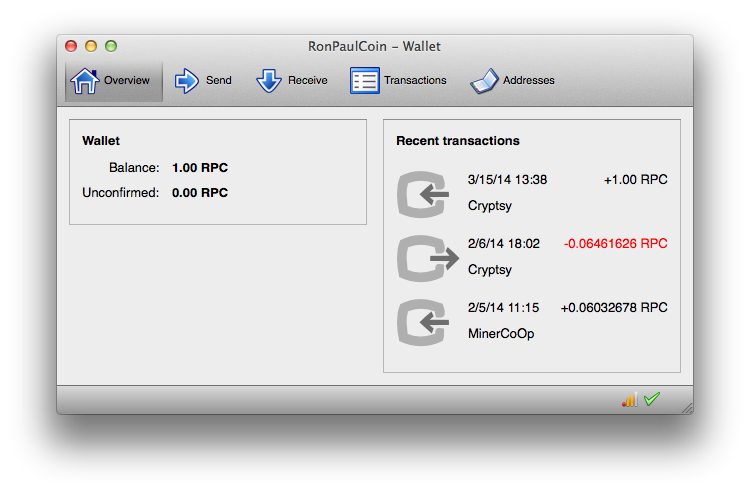

Back when RonPaulCoin was trading around $18 it was too much, even for the novelty. I mined it for a little while, but it became clear that the value would just continue to drop, so I sold my RPC for Bitcoin and called it a day. Even when it came down to $3.50 I was still skeptical that I really cared enough about it to spend even that much on it. So a couple of weeks ago I put in an order on Cryptsy for a single RPC (actually 1.001 RPC so that I could pay for the transaction fee for withdrawing my coin from the exchange). I put that order in at about 85% of the then-current trading price — about $1.24.1

Today that trade went through. RonPaulCoin dropped from $1.83 to 78¢ in less than a day, and most of that drop happened in the space of an hour. As someone was selling RPC at progressively lower and lower prices, my automatically set up trade went through.

Losing 46¢ in value is not a huge deal, but this one sell-off made me curious and I checked the values of other alternative cryptocurrencies. It appears that there was a big sell-off of alt-coins on Cryptsy between 8am and 10am PDT. The cluster, all in one brief time period, makes me suspect that this was one person dumping their altcoins.

Here’s a sample:

| Coin | Symbol | Dropped from | Dropped to | % Loss | Volume | Volume in BTC |

|---|---|---|---|---|---|---|

| Argentum | ARG | ₿0.00007303 |

₿0.00006001 |

18% | 9,017 |

₿0.11857314 |

| CacheCoin | CACH | ₿0.00611191 |

₿0.00551000 |

10% | 223 |

₿0.13422593 |

| Digitalcoin | DGC | ₿0.00009304 |

₿0.00007305 |

21% | 32,046 |

₿0.64059954 |

| DOGECoin | DOGE | ₿0.00000137 |

₿0.00000131 |

4% | 67,948,000 |

₿4.07688000 |

| Maxcoin | MAX | ₿0.00017210 |

₿0.00015010 |

13% | 637 |

₿0.01401400 |

| RonPaulCoin | RPC | ₿0.00222089 |

₿0.00121825 |

45% | 119 |

₿0.11931416 |

| SaturnCoin | SAT | ₿0.00000006 |

₿0.00000003 |

50% | 68,898,629 |

₿2.06695887 |

| StableCoin | SBC | ₿0.00000497 |

₿0.00000308 |

38% | 55,057 |

₿0.10405773 |

| SmartCoin | SMC | ₿0.00000908 |

₿0.00000609 |

23% | 49,057 |

₿0.14668043 |

| Spots | SPT | ₿0.00000662 |

₿0.00000484 |

27% | 72,998 |

₿0.12993644 |

| SecureCoin | SRC | ₿0.00041985 |

₿0.00034587 |

18% | 2307 |

₿0.17067186 |

| SexCoin | SXC | ₿0.00000704 |

₿0.00000654 |

7% | 16233 |

₿0.0081165 |

| PrimeCoin | XPM | ₿0.00215571 |

₿0.00210969 |

2% | 385 |

₿0.0177177 |

| Zetacoin | ZTC | ₿0.00001092 |

₿0.00001009 |

8% | 40,403 |

₿0.03353449 |

The total volume for all of these is about ₿7.75, or a little less than $5,000. It seems totally plausible that this was mostly the result of sales by a single individual. Heck, that’s not even a very big set of trades.

I don’t have enough market cap data in front of me to chart out the market cap losses from this one sell-off, but as an example, someone selling $2,500 worth of DOGECoin cut $2.3 million out of DOGECoin’s market cap. $410 worth of Digitalcoin dropped DGC’s entire market cap by $179 thousand. Relatively small sales (and purchases) have large effects on the overall price (and therefore market cap) for two reasons: first because so many people are speculatively holding on to coins (hoping that they will increase in value) the percentage of coins actually for sale at any time is very small; and second because there are so many currency exchanges that a small number of trades can cause a big change in price at one exchange. However, people see that happen in one exchange and the effect ripples to the other exchanges as people buy, thinking that they will be able to sell at the higher price at the other exchange or sell .

It’s important to note that not all of those have stayed low — for example Digitalcoin has since recovered to ₿0.00008895, and that is in a very short period of time. But it looks like someone just dumped a bunch of altcoins in favor of BTC and LTC. BTC is up slightly against USD today, but there’s no way to see what the Cryptsy effect was and it is likely negligible. On Cryptsy, LTC rose during this time from ₿0.0263610 to ₿0.02704350. That difference is local to Cryptsy and seems to be adjusting. None of this is really any more than a blip on the radar in the big picture.

What it means

However, this event illustrates the problem with altcoins: the only way to get value back out of most of them is to sell them on an exchange, so their ability to act as a store of value is tenuous at best. This accusation could be leveled at Bitcoin as well, but in fact it is possible to buy a lot of goods and services with Bitcoin. Someone wanting to get out of the Bitcoin market could spend their Bitcoin on subscriptions to dating sites, computers, website hosting, bullion, pizza, drugs (allegedly), or whatever.

The point is not how much stuff you can get with Bitcoin, but that liquidating Bitcoin doesn’t have to devalue the currency. Purchasing goods and services with a digital currency makes the currency more desirable in the real world whereas selling it on an exchange just drops the value of that currency.

It’s easy to boil this down to the idea that highly speculative currencies without backing have high volatility. That’s true, but a bit simplistic. It’s not just regular volatility, what we’re looking at is instability and vulnerability to large changes by small causes.

When evaluating the long-term viability of any cryptocurrency2 the most important thing to ask is: what goods and services can be bought.

Therefore, I really only have confidence in a small number of currencies:

- Bitcoin

- Litecoin (though I have other reasons for disliking Litecoin)

- Digitalcoin3

- Dogecoin (I hate Dogecoin but I can’t ignore that it has gotten traction in goods and services)

- Namecoin (though largely limited to domain names in a TLD that most people don’t and can’t use, the value is indeed linked to the blockchain)

There are of course other reasons to invest in an alternative digital currency. I like Peercoin for the way in which it is set up — a very small rate of inflation is, despite what many (with whom I agree) say about the damage caused by inflation, a healthy thing in a currency. Vertcoin has a lot of potential because of the security that comes from its use of multiple algorithms. However, these factors are only reasons that a particular currency might be adopted for general trade at some point in the future. In other words, the success or failure of a digital currency will always come down to what people can buy with it. Everything else is speculation.

- I was purchasing with Bitcoin. Since it fluctuates in price the amount today and the amount a couple of weeks ago probably aren’t quite the same. ↩

- Probably true of all currencies, but to a much lesser extent. ↩

- The developer of Digitalcoin has put a lot of effort into creating exchanges and auction sites for Digitalcoin. None have taken off, but the capability to do trade in real goods and services is a big step in the right direction, especially for a currency in other ways as immature as Digitalcoin. ↩